Discover the advantages of payroll outsourcing in terms of cost control and internal control mechanisms. Learn how it can enhance operational efficiency and minimize errors and frauds.

Most of the organizations are thinking payroll outsourcing is an expense that can be avoided, some thinks it is cost saving initiative but only few thinks it will bring internal control system that can avoid ghost employees, non-spreading of salary and benefit information of employees, Human resources can be used for better jobs.

What is Internal control System:

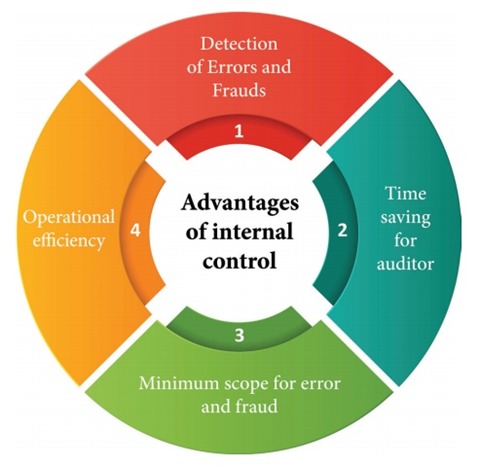

There are many advantages for the internal control system but we have captured only 4 important ones.

- Detection of Errors and Frauds

- Time savings for auditor

- Minimum scope for error and fraud

- Operational efficiency

Detection of Errors and Frauds:

Payroll vendor once he collects the input from the clients, they scrutiny the data and validate before processing. PDCA, Plan, DO, Check and ACT process happens internally. Payroll vendor hires the best talent in the market and deploy them in the process so that they identify and eliminate the errors completely. The processing officer in the payroll company have no vested interest in the data so they will not indulge in the frauds.

Time Saving for auditor:

Every client spends lots of time for generating the reports if the payroll process happens internally. Finance / Audit team internally depends on the HR / Payroll team for the data but most of time, the team would be engaged in some other priorities hence there will be delay in obtaining the data, on the contrary, payroll vendor could able to provide the data within no time as they have the best system and all resource available to support.

Minimum scope for errors and frauds:

As I mentioned earlier, there won’t be any vested interest for the 3rd party payroll vendor to indulge in the fraud activity. Except HR / payroll office in the client end, no one can contact the payroll vendor hence there is no scope of fraudulent. In terms of errors, Payroll vendor have the system / dedicated resources to upload the input, check the draft output, validate / quality check by the team lead and final authorization of the manager before it goes to the client hence it is minimum scope for errors.

Operational Efficiency:

This is most important element in the whole cycle. The client can utilize their resources on the development activities rather than using them in a transactional activity. By eliminating the errors, there is no need to redo the payroll cycle and avoid employee dis-satisfaction. Frauds is another compliance issue that can create huge impact on the image of the organization, this can be avoided by outsourcing the payroll activity.

Hence payroll outsourcing is not just a cost saving activity but it can provide best internal control system and operational efficiency of the organization.